I tried to come up with a clever title for this and I got nothing so we’ll move right along. Here’s a question for you. Do you have a Will? Do you have Living Will? If you own a home, do you have a Trust? Do you have a power-of-attorney for your spouse? If you have kids, do you have a guardian assigned to take your kids should something happen to you and your spouse?

All very “adult” questions that make me think of this awesome t-shirt my friend sent me.

But adult we must. If you don’t have these things done (will, living will, power of attorney, trust, etc.), take a quick 5-10 minutes and read this. And then get.it.done. It will save your kids/posterity a lot of headache. You’re doing them a huge favor and yourself a big favor should something happen to you or your spouse.

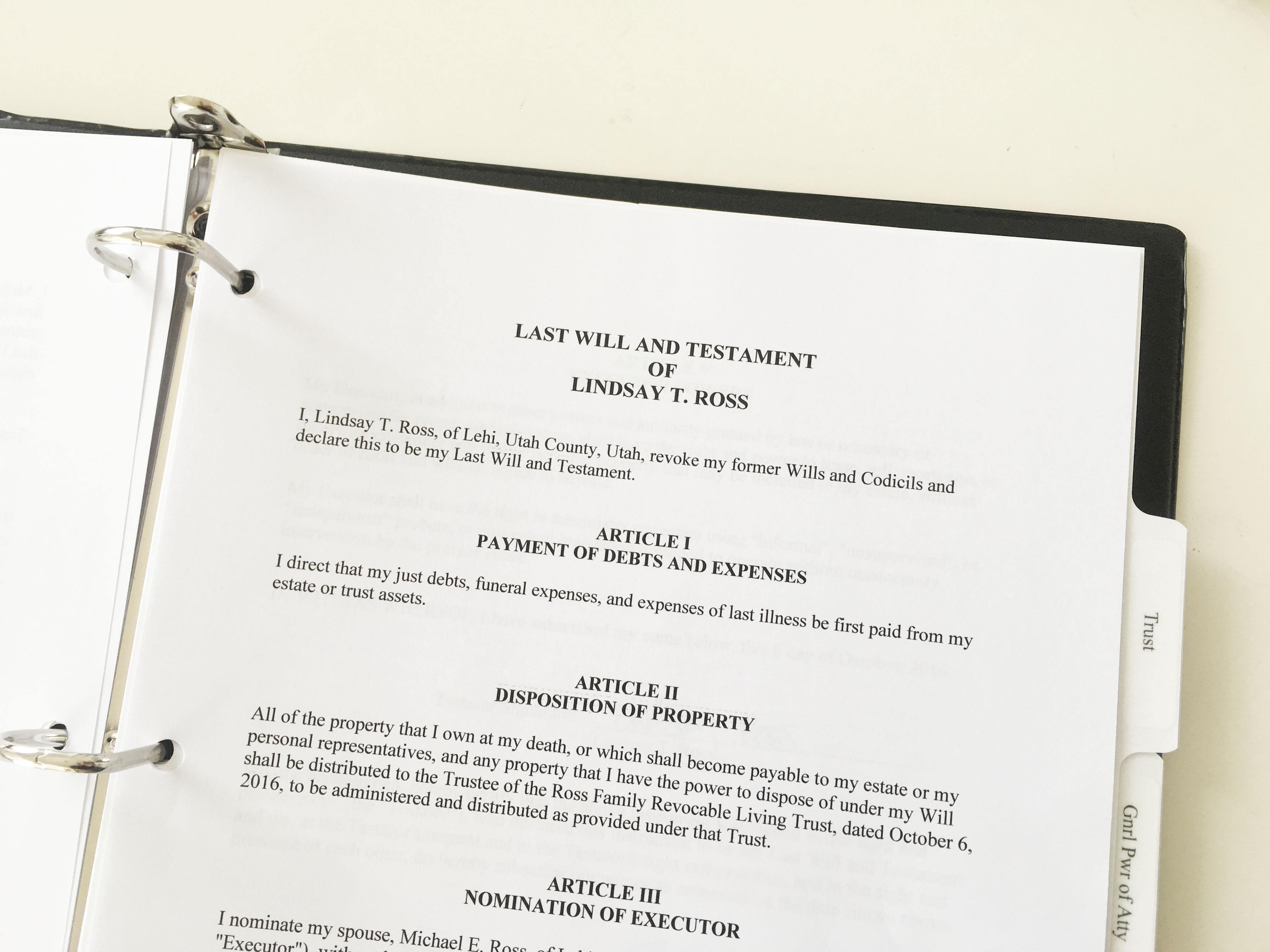

My husband and I drafted up a Will soon after we had our first kid. I did a freak out about who would get our daughter if we both went down in a blaze of glory on a trip or something. I’m a worst-case-scenario thinker sometimes. I didn’t care so much about our stuff as I did about assigning a guardian. So we got documents for a Will, put in our guardians, left everything to the kid (and whatever future kids we may have) and that was the end of it.

Fast forward to today. We now have four kids instead of one. We own a home and have a few other assets we’ve collected along the way, although I’ve been slowly getting rid of stuff because less crap in my house makes me feel a whole lot better.

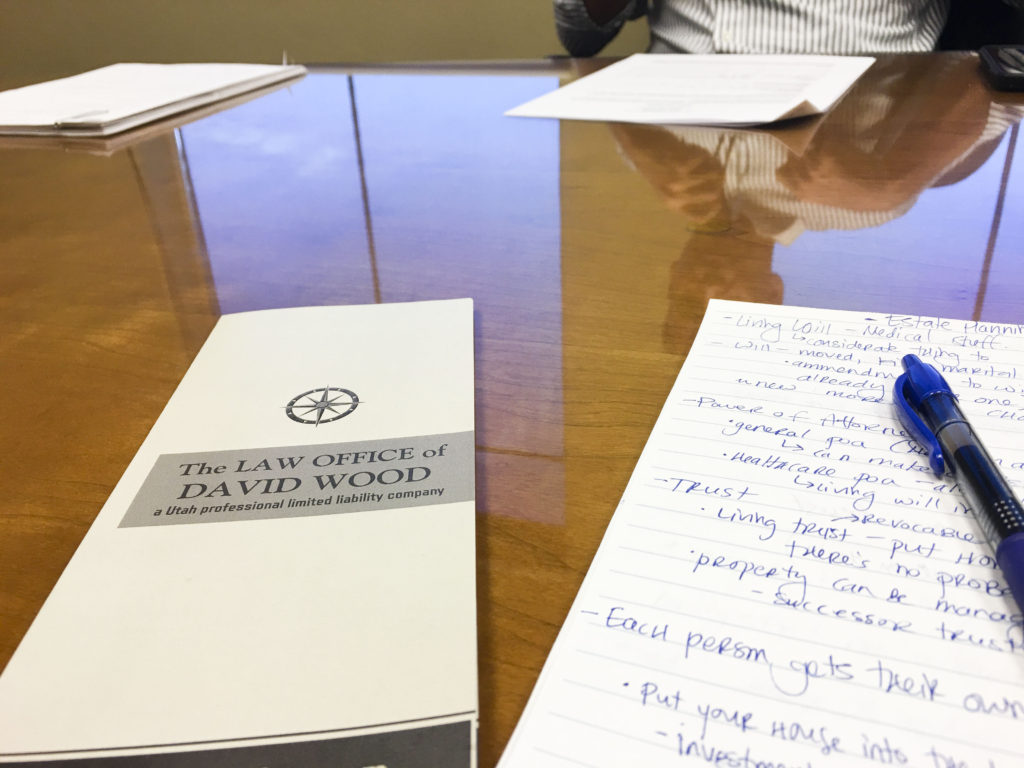

Anyhow, I honestly haven’t thought much about the Will since we quickly drafted that first one until a friend of ours, David Wood who is an attorney and is specializing in estate planning contacted me to see if we wanted to get our stuff done (thank you David). I’ve also been thinking about it the past few weeks as more and more people in our lives are faced with these hard decisions right now. Holy cow life is hard.

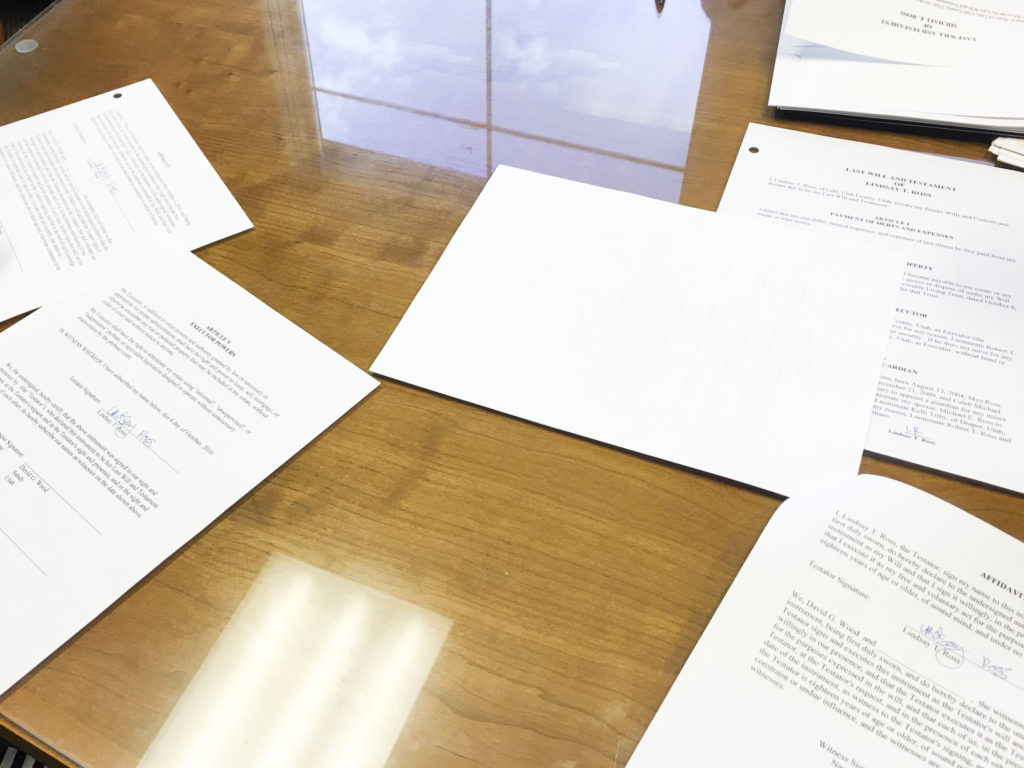

David did the estate planning for us and I’m blogging about our experience. I’m pretty choosy about what I’ll talk about here on the blog. I try to only blog about things I know will truly help people and make a difference in someone’s life. This is certainly one of those topics.

I know there are a lot of DIY folks out there who like to try and do things on their own (which in some cases is awesome), but this is one of those areas I think it’s definitely worth having someone who knows what they’re doing make sure you’re doing everything right. It will save a lot of headache on the flip side of all of this and I think it’s 100% worth the investment to get it done right.

The four big things we focused on: Will, Living Will, Trust, Power-of-Attorney.

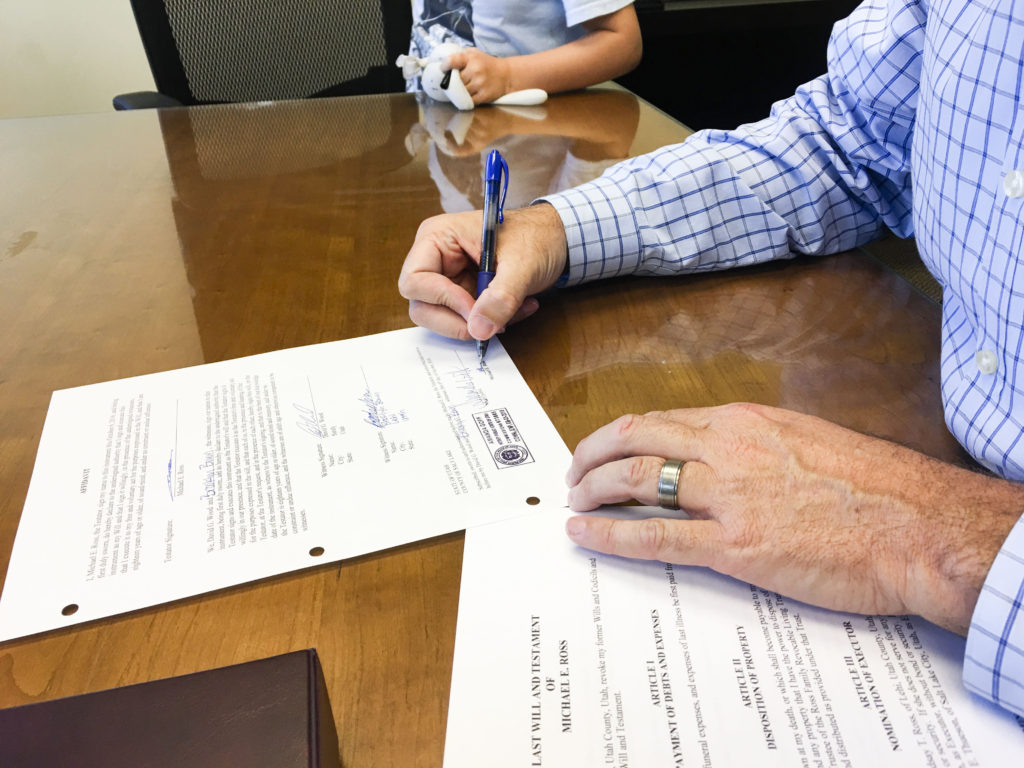

My guess is we all know what the Will is for. You decide who gets your stuff when you die. You can be broad and just split everything evenly or you can get detailed down to who specifically gets your trophy from little league baseball. Totally up to you. It is also where you assign a guardian for your children (holy stressful–I don’t want anyone to get my kids but if that happens, I’d like to be the one who decides where they go). Along with assigning beneficiaries for your stuff, you assign an executor to carry out the wishes of the Will. It was helpful to have David walk us through who we should consider for that role and WHY. It’s not just picking your favorite sibling.

Living Wills. This is doing a HUGE favor for you family. Your spouse. Your kids. YOU decide what happens to you should you be in a medical emergency and some big decisions have to be made. You decide when/if you are sustained on life support. You decide if and when someone should “pull the plug”. Taking those decisions out of someone else’s hands is honestly a merciful thing to do. You also assign a healthcare power-of-attorney who will make these medical decisions for you. Mike is mine, but should we both be in a situation where we’re fighting for our lives, I have another person assigned should Mike not be able to do it. And Mike and I have different people as our healthcare deciders should we both need those decisions being made at the same time (the odds of this happening are hopefully slim, but it’s certainly a possibility). Again, so helpful to have an attorney walking us through those decisions and who we may want to consider. Obviously hoping no one ever has to make those decisions, but it makes me feel a lot better knowing that’s taken care of should the need arise. Do your family a favor and get this one taken care of.

Power-of-Attorney. The person who can do stuff on your behalf. Spouse is the obvious first choice, but it’s good to have a second person in line.

Trust. This is one I was totally clueless on and didn’t know the importance of having one. The short version–in your Will you decide who gets your stuff (house, cars, personal belongings, bank account money, etc.). But. If you don’t have those assets in a Trust, your beneficiaries have to go through probate before they can get it. Probate is where you have to go to court (insert long and loud groan here) to prove the validity of the Will and the whole affair is made public. It costs money and it takes time (could take lots of time if the estate isn’t left in order). If you have your assets in a Trust, there’s NO probate and everything is dealt with privately. The Will is carried out by your executor, and the trust is managed by your trustee (could be the same person as your executor) and the beneficiaries are able to collect on the things assigned to them withOUT having to go through probate. No lawyers at this point. No judges. No court. Can I get an Amen.

I didn’t know this and I’m SO glad I do. Probate sounds like a big headache and can be expensive. You have to hire a lawyer to go through this process and it can take several months to sometimes several years. Holy nightmare. (I’m also making sure my parents have that all taken care of so we don’t have to deal with courts when they say peace out and go to the after-life).

Get your stuff in a Trust (home, bank accounts, etc.). As soon as possible.

Obviously this is the sweet and short version of all of this. When you go through this process with a lawyer they’ll explain everything in detail, walk you through the decisions you have to make and help make sure you do everything correctly so you can avoid some headache in the future. Yes, you’ll have to pay some money right now, but it will give you peace-of-mind and will end up saving your beneficiaries money and time later on.

Not super exciting or glamorous stuff to talk about, but one that seriously needs to be done. And no more “I really need to do that.” Just do it. You’ll be glad you did.

If you’re looking for a lawyer, I highly recommend David Wood who did our estate planning for us. The whole process was super simple and we were done in less than an hour (because I had lots of questions–could have been faster if I wasn’t a question spaz). He was patient and answered all my questions, helped us make the decisions of people we needed to assign for various tasks and is making sure we have our Trust completely set up (there are steps you have to take after you draft the document that some lawyers don’t stick around to help you out with). I also like the way he does his fees. Some lawyers will charge hourly rates and those can add up quickly and feel vague–you have no idea what to expect on costs. David charges a flat fee so you know upfront what you’ll have to pay.

Regardless of what lawyer you choose, be sure to choose someone you can trust, someone who knows what they’re doing (just because someone is a lawyer doesn’t mean they specialize in this specific area), and someone with a fair fee ($1500 or maybe a little less is realistic in my opinion).

While we’re talking about this, also be sure to GET LIFE INSURANCE!!!!! I’m not going to go in to that on this post, but it’s definitely something you want to do while you’re getting your estate in order. My friend Jenni’s husband passed away from an awful battle with cancer and this is one thing she is a huge advocate for (her post is definitely worth reading).

Definitely some things to think about and some action to take. Who gets your stuff, who gets your kids, who decides what kind of medical care you get if you can’t make those decisions, who can make decisions on your behalf. Just reading through this whole thing means you adulted today. Well done. Now on to the action part….